Level-Funded Plans

EMI Health offers an innovative mechanism for groups to blend the flexibility of self-funding with the risk protection of being fully-insured.

Right in the sweet spot

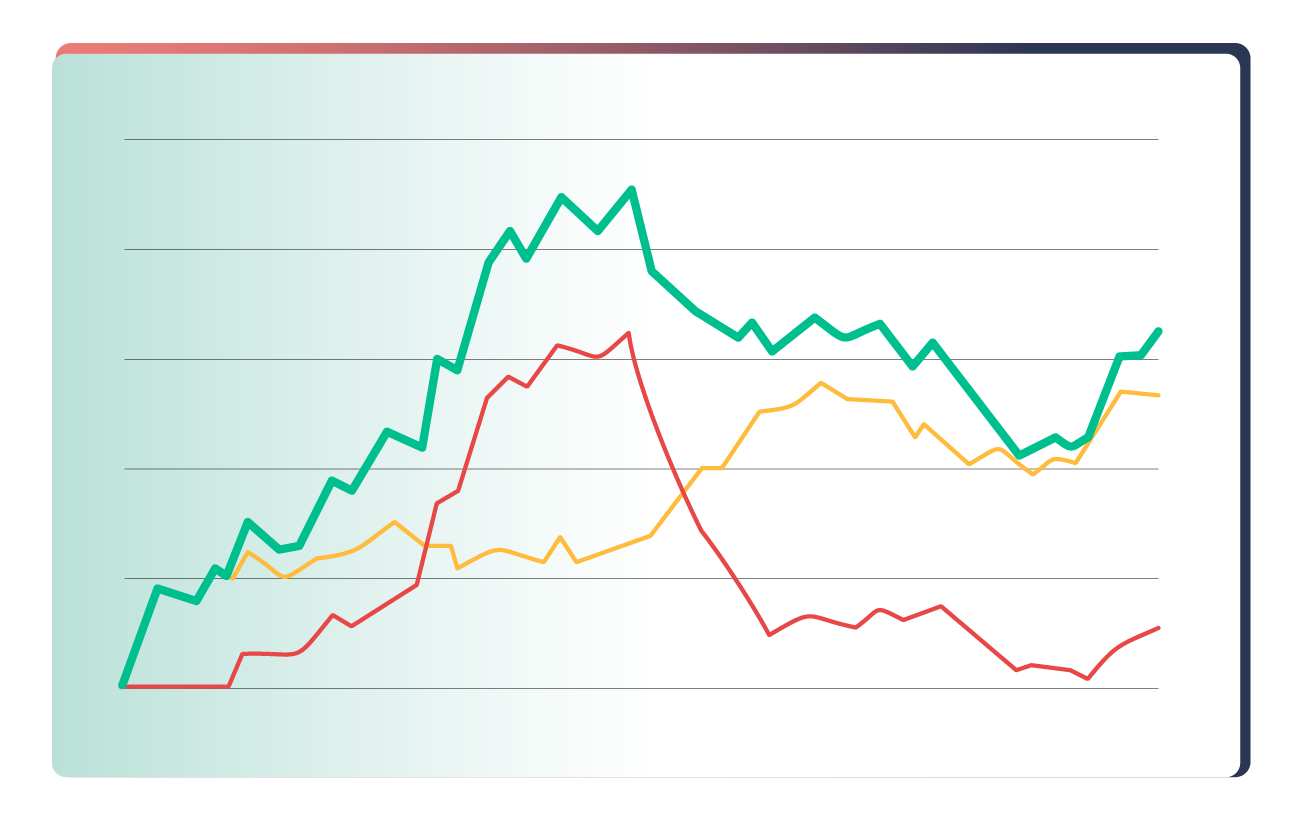

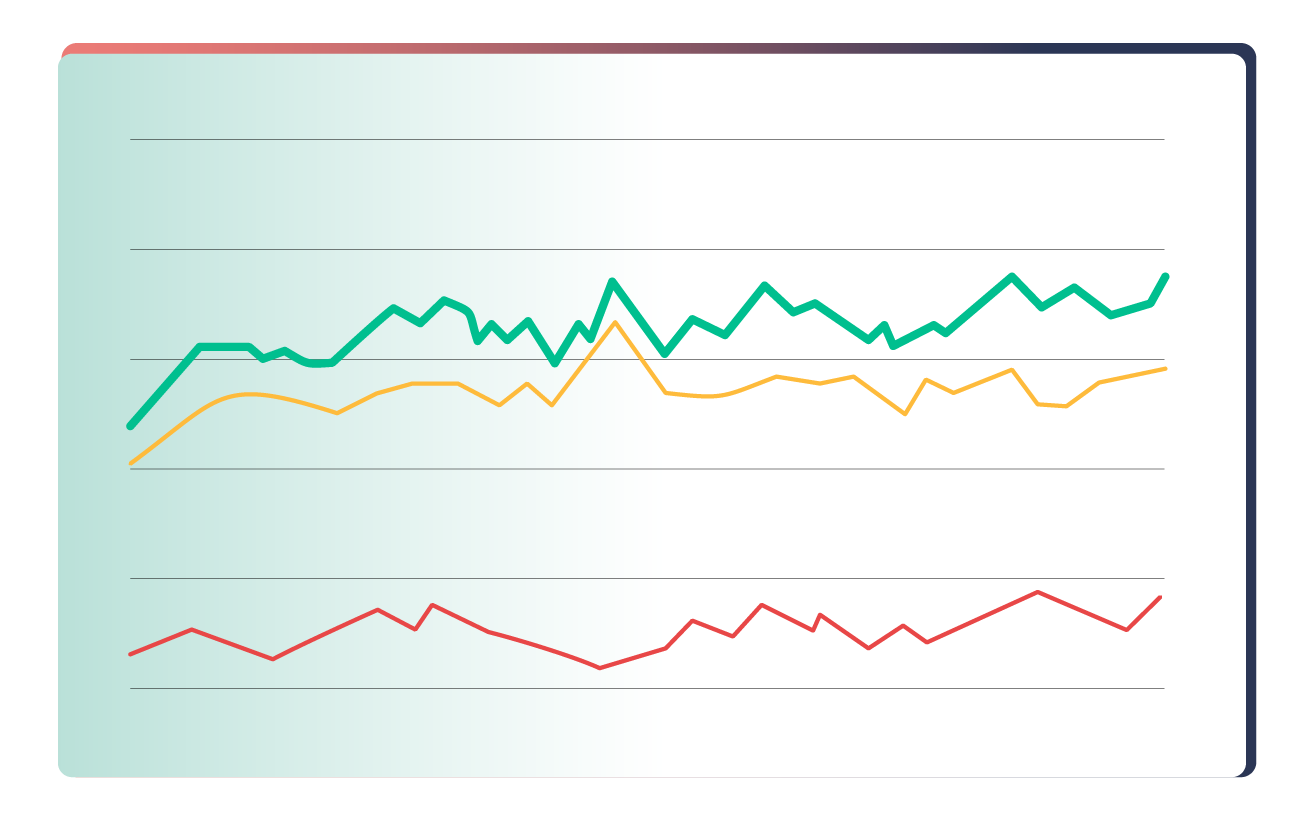

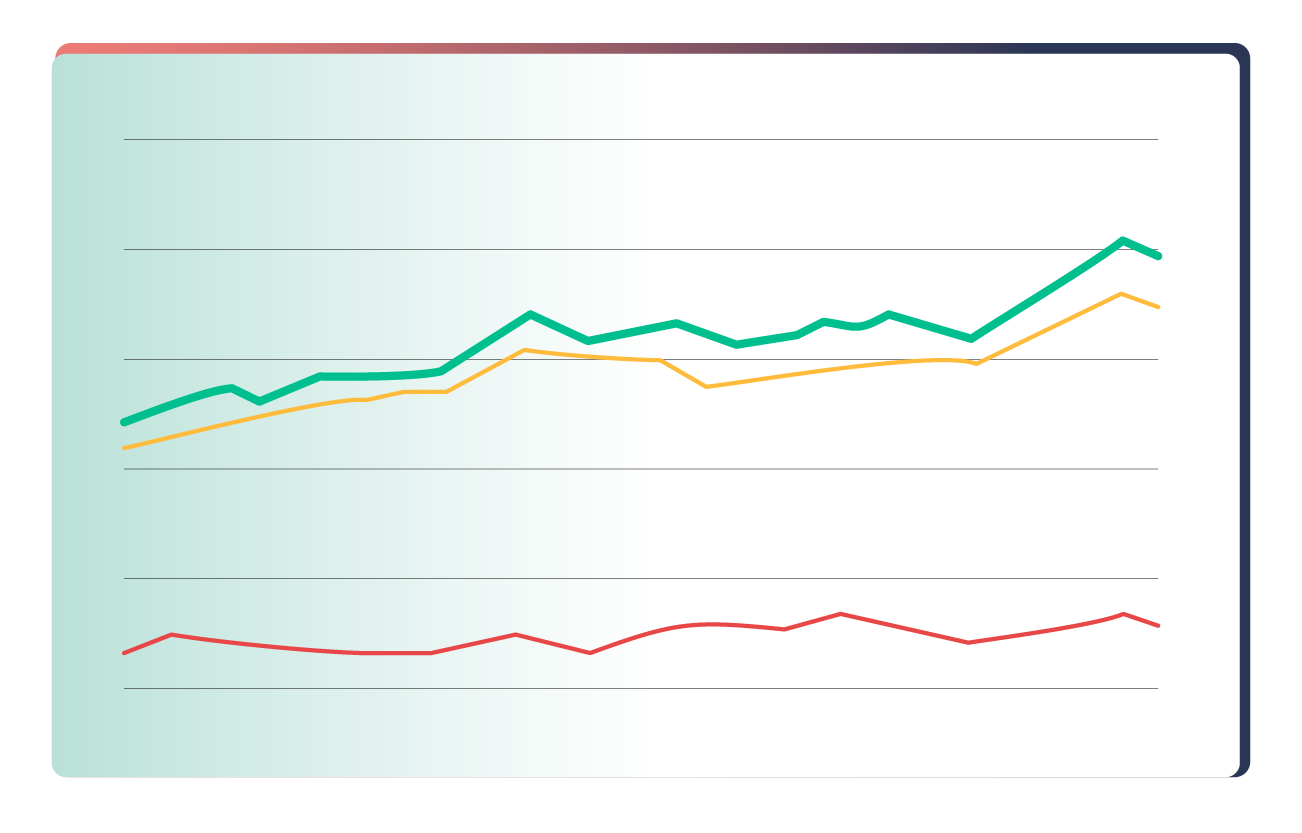

Our level-funding model gives you the flexibility of self-funded plans, with the risk protection of fully-insured plans. Our unique solution effectively gives you stable renewals year after year, and we have options for both large and small groups to take advantage of it.

Here’s the cherry on top: if claims are higher than collected premiums in a year, you don’t have to pay a cent more to cover it. And if claims are lower? Great news! You are eligible to get 100% of the surplus paid back to you.

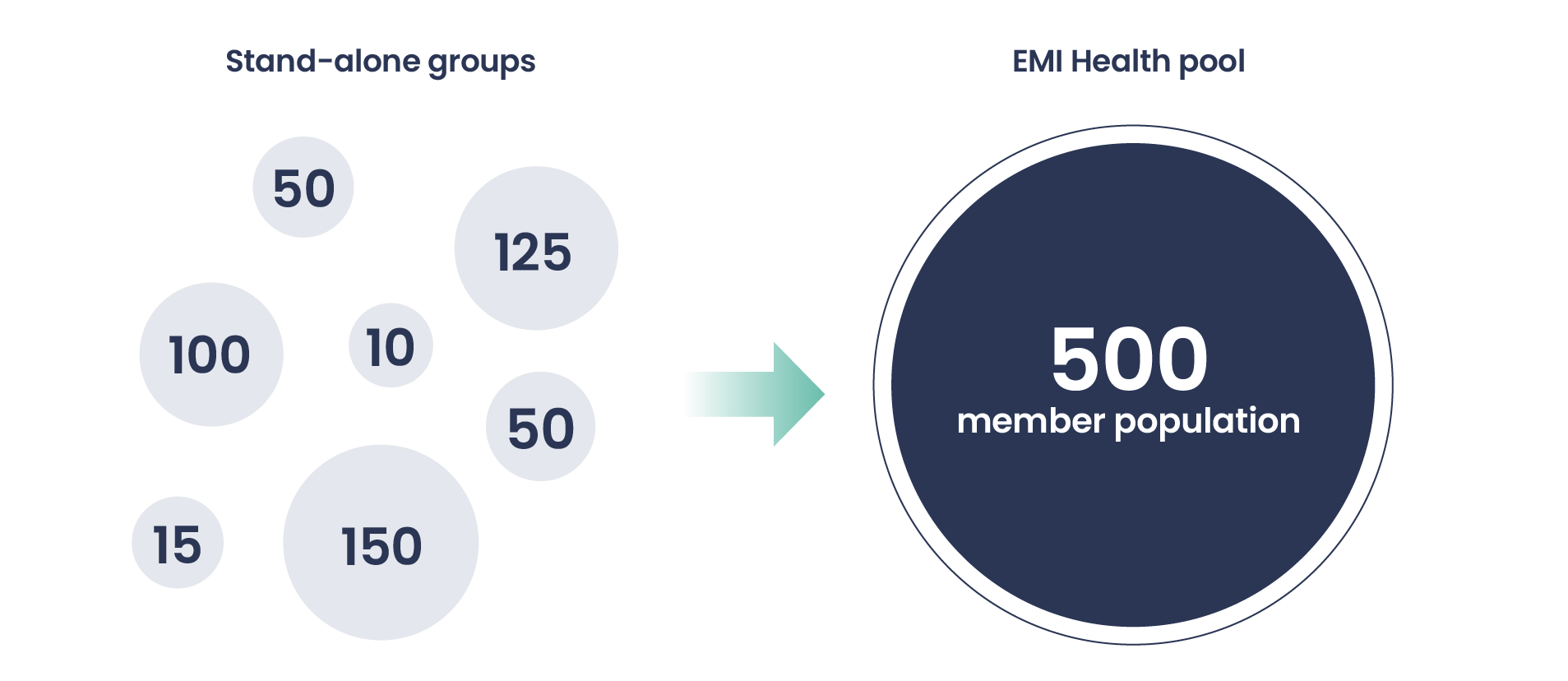

There’s strength in numbers

Small groups are often at a disadvantage in the insurance market because it’s harder to spread risk on a smaller population. But we have an innovative solution at EMI Health to give small groups access to our level-funding model. To achieve this, we “pool” similar organizations together and underwrite the combined population’s risk. Instead of being a group of 50 members, you can be qualify to be part of a pool that has 500+ members!

Have a seat at the table

At EMI Health, we believe in transparency and data-driven decisions. When you join a pool, you are invited to join in semiannual pool meetings where our expert team goes over everything new from EMI Health, how the pool is running, upcoming market changes, and more. Pool reporting can be shared with you and can help determine plan choices for the next year. Get all your questions answered and have your voice heard.

Learn more about level-funding with EMI Health

This short video helps explain our level-funded pools in general.